First of all, it should be noted that heat in Europe is used for various purposes in order to fulfil the European final energy consumption demands. For example, the demands for heat of high and medium temperatures dominate mainly within the industry for melting, evaporating and drying processes. Space hating and the supply of domestic hot water are the most common low temperature heating demands. These demands tend to appear in residential, commercial, industrial as well as public buildings. Some amount of heat is also used for cooking. The factors defining the amount of heat demands usually depend on the activities of different community sectors.

Heat is mainly produced from primary energy supply by way of calorific value conversion, which is used for various kinds of fuels such as coal, peat, fuel oil, natural gas, wood chips and pellets, and firewood. Moreover, electricity can also be easily used for meeting heat demands which appear at all levels of required temperature. Heat pumps as well as collectors which work on solar energy produce small amounts of heat of low temperature. In contrast, considerable amounts of heat are retrieved from industrial, power and waste incineration processes. This heat is normally produced far from the heat demands. That is why district heating systems which are responsible for the urban heat provision are used for gathering,

Complementing peak and back up supply, distribution, and supply of customers, all these methods of heat provision produce different amounts of primary energy as well as different greenhouse gas emissions.

Numerous heat carries are also used for short or long-distance transfers of heat from the heat sources to the final consumers: flue gases, air, water, steam or highly specialized heat transfer fluids. Water is the most consumed heat carrier in both space and district heating systems.

Furthermore, the heat market has experienced significant development with the lapse of time. For example, ancient romans used hypocausts for the flue gas distribution below floors in the buildings. That was the first organized space heating. Steam heating emerged in the 18th century and was mainly used for the industrial purposes. However, the first relatively appropriate organization of the residential space heating took place in the 20th century. The space heat market evolved from using coal and firewood to efficient boilers and central heating in residential areas. The first institutional European heating systems for urban districts were installed in the late 19th century and the first urban-based commercial heating system was established in 1921 in Hamburg.

According to the numerous conditions on the climatic, national, regional, and local levels, space heating demands have been met through various ways in Europe. For example, some countries in Europe provide a more extensive usage of natural gas in local boilers. In other countries, the low temperature market dominates in district heating systems. In the area of Mediterranean countries, space heating traditionally has a low level of organization. Therefore, the European heat market has high level of diversification, which is achieved by offering and using many different solutions in order to satisfy the demands of the final consumer at an acceptable cost.

In 2013, there was an increase in the sales figures at the heat pump market in Europe - the amount of heat pump units that were sold rose by 3 per cent. In 2014, EHPA (the European Heat Pump Association) reported that the total number of heat pump units which were sold in the 21 European countries mounted up to 769, 879. It should be taken into account that over the course of the last twenty years the total amount of the heat pump units that were actually installed exceeded 6, 74 million.

As far as the heat pump market is concerned, three main tendencies should be mentioned: air remains the key source of energy for heat pumps; the sector of heat pumps operating on sanitary hot water is the most developed and growing sector, the usage of sanitary hot water heat pumps being widespread throughout Europe: it should be noted that in this sector, there has been a double increase of figures. As far as hot water heat pumps are concerned, they consist of a heat pump and a storage tank filled up with hot water. There are two types of these units: holistic ones, in which the heat pump and the storage tank are in one casing, and combined ones - those are systems which consist of the separate heat pump and storage tank. Finally, the last tendency to be mentioned in regard to the heat pump market is that larger heat pumps which are applied for industrial, commercial and district heating purposes are becoming more and more popular these days. These heat pump units usually use geothermal or hydrothermal energy. However, a number of installations use air as the main source of energy as well.

It should be noted that the general agitation at the heat pump market in Europe began only after 2012, which was a rather difficult year for the sphere.

In order to be able to understand properly the state of things at the European market as a whole, the outlooks of separate countries should be taken into consideration. In this regard, 15 out of the 21 markets have experienced a positive dynamics and growth. In some countries, there has even been a double-rise of numbers. Moreover, in such countries as Portugal, Sweden, Spain and Finland, things have changed drastically as until 2012 their heat pump markets experienced a decrease tendency. It should also be mentioned that the general situation at the heat pump market of Europe is substantially influenced by the positive dynamics and development in the countries with the largest markets - these are at present Sweden and France. Besides, growth rates increased even more between 2013 and 2014.

It should be taken into account that the increase in the heating sector is mostly affected by the development and growth in the sector of construction. That means that if the building sector develops slowly, the same tendency can be observed in the sales of heat pump units, that is, the sales rates hardly grow. The reason for that are obviously strict building requirements: when a heater is installed or substituted, heat pump technology is chosen much more often.

As far as the government is concerned, it should be noted that despite the obvious advantages of the heat pump units being increasingly installed in Europe, which is a part of the climate and energy targets set for 2022, the heat pump technology still finds little support from the governmental bodies.

In general, the total amount of heat pump units that were installed since 1994 comprises more than 6, 7 million. This number corresponds to the installed heat pump capacity in the amount of approximately 224 GW. Besides, all installed heat pump units produce 120, 8 TWh of useful energy, renewable energy being 77, 8 TWh. The use of heat pump units helped to save 99, 1 TWh of final and 47, 1 TWh of primary energy.

On a country level, the biggest amount of renewable energy is produced by France, Sweden being on the second place. They, together with Italy, Germany, Finland and Norway, form a group of six countries which produce 62,38 TWh, that is, more than 80 per cent of the total amount of the renewable energy production arising from heat pump technology.

The heat pump stock units that were sold over the course of the last twenty years also made a significant contribution to the savings of greenhouse gas emission in the amount of 20 Mt. It should be noted that the amount of emission savings per country distributed similarly to that of the renewable energy production. The reason for this is that both figures are linked directly to the number of heat pump units that were installed during that time.

Although there is already quite a positive dynamics in the heat pumps sector, analysts expect it to grow and develop even faster - the best-case scenario is the decrease of greenhouse gas emissions by 47 per cent in the construction sector (as compared to the current level of emissions) by 2030.

As far as residential water heating market is concerned, it is no surprise that Germany has had the lead until now, its market being the largest one, with revenue share mounting up to 30, 9 per cent in 2000. In spite of this, there has been a continuous drop of this percentage share over the course of the next three years - and this tendency has remained to these days. Due to the fact that Germany has a rather stable market as far as its total revenue value is concerned, it is eventually losing share to all the other large national markets as they are constantly expanding.

The next largest markets, with revenue shares in the amount of 22, 3 and 19, 1 per cent, belong to Italy and France respectively. However, Italy has also experienced a strong decline since 2000 while the market situation in France is directly the opposite: its market reached a 20, 2 per cent revenue share by 2006 and became the larger of the two.

As for the United Kingdom, it has a rather unchanging and steady market, its growth and rates being linked directly to those of the total European market as a whole. However, it should be noted that on a national level, the combination boiler sector has experienced a significant growth while the dynamics of other water heating technologies has not been so positive.

One more market that should be mentioned in this regard is the Spanish one, which is considered to be the smallest and the most insignificant one. In 2000 it accounted for only 10, 5 per cent of revenue share. The reason for this is that at the moment the Spanish market is rather poor-developed. Still, a slow growth could be observed during the next years, the revenue share rising up to 13, 3 per cent by 2006.

To sum up, it should be noted that the residential water heating market in Europe is quite well-developed and stable, with particular sectors either constantly growing or declining. The only exception is the combination boiler sector, which has experienced a total increase in numbers throughout the whole Europe. It should be taken into account that the decrease tendency in the other water heating product sectors is mainly due to the agitation and growth in the combination boiler sector.

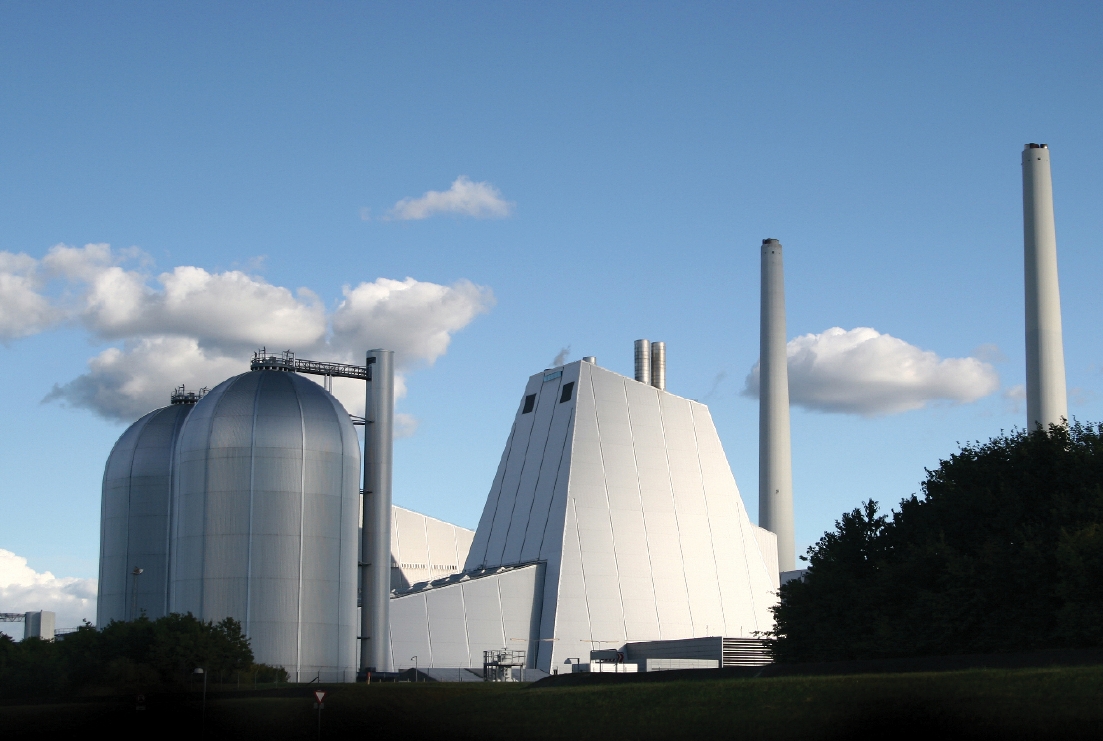

Combined Heat and Power is a process that transforms primary energy into thermal and electrical energy. As a rule, the generated electricity is used on the local level and is fed into the grid while the thermal heating energy is produced in order to be used in district heating applications and industrial heat installations when some heat is necessary for the process of production. The industrial process heat is usually distributed and used for low-pressure steam production. The most common way of heat distribution in the branch of district heating is pressurized hot water supply. There are also steam systems available which are remarkably less efficient in the process of energy production. Such systems are particularly inappropriate in the process of heat distribution over the long distances.

Nowadays, CHP installations are mainly applied in the areas of district heating, in the industrial processes as well as for the small-scale CHP solutions. CHP is highly-developed and mature technology and in most cases the same types of basic equipment such as boilers, steam turbines, combined cycles and gas engines are used for the separate heat and electricity production.

For the time being, combined heat and power technologies are widely used in the European countries. According to the estimates of the European Commission in 2008, CHP assists in reducing greenhouse gas emissions within the European Union by 100 million tons per year.

Thus, the total capacity of the installed CHP in the European Union was 105.3 GW in 2011. 375.5 TWh of energy, which is approximately 11% of the total power generation share, was produced with the help of combined heat and power plants.

CHP plants share varies considerably among the countries of Europe. The largest share of CHP is in Latvia, Denmark, Lithuania, Finland and the Netherlands. In absolute terms the largest producers of CHP electricity are Germany (26.6 TWh) followed by the Netherlands (9.2 TWh) and Poland (8.8 TWh). These differences reflect different national policies of the European countries along with the climatic issues and other factors.

As for the Southern Europe, combined heat and power plants are predominantly used for industrial steam generation. The using of combined heat and power installations for the industrial and heating purposes is more common for the countries with a colder climate and large amounts of heat loads. For example, in Finland, more than one third of produced electricity was generated by industrial CHP plants, which means that a significant amount of the industrial steam is also generated by CHP plants. In Poland approximately 60% of heat is produced with the help of combined heat and power plants and is consumed by the household and in the processes of industrial production. Countries which succeeded in development of the district heating (DH) networks in the urban centres have a significant advantage in CHP engagement. Constructing DH may be sometimes economically unviable.

The biggest share of district heating and cooling is in Denmark, Estonia, Lithuania and Latvia, where 60-70% of citizens are served by district heat.

The European domestic heat installation market is experiencing shifts, which means various risks and threats for both manufacturers of the installations and utilities. Moreover, for the time being there is a potential for pioneering technologies and new competitors to enter the slow-changing sector.

According to DG ENER and Eurostat estimates, in the European countries the energy production for buildings accounts for nearly 40% of the overall European energy consumption. About a half of this rate - nearly 20% - is used for space heating in residential areas, which may be defined as domestic heat sector in Europe.

First of all, it should be stressed that the amount of energy consumption for the heating of the households does not differ dramatically from the industrial consumption. The total consumption may be estimated at around 150mn tons of oil equivalent (Mtoe). The biggest part of this consumption is reached by such fossil fuels as natural gas and oil as well as electricity.

Historically, the domestic heat sector has not been put under the microscope by the European policy makers. However, today we can see that more and more low carbon alternative options are appearing at the market. These choices are highly competitive with the traditional boiler solutions.

The analysts predict that over the next decade there will be more technologies to compete with the traditional heating installations. So the key technologies which are able to displace traditional appliances are biomass boilers, boilers plus solar thermal systems; electric heat pumps (air source and ground source); gas heat pumps; hybrid heat pumps (the combination of a boiler with an electric heat pump and micro-CHP systems (boilers that generate both heat and electricity). According to the analysts' forecasts, for the UK, Germany, France, the Netherlands and Italy, it is clear that boiler market is in a long-term structural decline.

As far as geothermal heating and cooling market in Europe is concerned, it can be mainly characterized as relatively stable over the last ten years. By the end of 2013, the 68 geothermal power plants operating in Europe reached the installed capacity of approximately 1,850 MW and produced nearly 11,7 TWh of electricity. During the same year, new power plants were introduced in Germany, Italy and Romania. It should be noted that in 2012 in Europe, geothermal energy comprised nearly 0.2 per cent of the total demand for electricity (around 2,800 TWh) and 0.9 per cent of electricity which was generated by renewable sources of energy( nearly 660 TWh). In the same year, the capacity of the geothermal power plants mounted up to 76 per cent due to the fact that some of them had to be repaired and decommissioned.

The countries that show the largest numbers of the direct use of geothermal energy are at present Hungary, France and Italy. It is mainly due to the fact that in these countries new large capacity facilities were opened between 2013 and 2014. It should also be mentioned that between 2011 and 2012, the total use of geothermal energy increased by nearly 25 per cent. At the moment the share of geothermal district heating comprises around 0.5 per cent of the total district heating market in Europe.

One can made the following conclusions as for the European heat market development. The final overall heat demand dominates the demand side in the energy system of Europe. The final demand for heat is defined by the natural gas supplies and the electricity generation. Due to the warm winters, the European heat market has specific and confined heat demands.

The main barriers for higher energy efficiency are the low prices for fossil fuels, European legislations relate mostly to the use of fossil fuels and do not recognise energy efficiency. Moreover, carbon taxes and carbon dioxide trading are in general not strong enough and have no coherent legislative basis. The investment amounts are not sufficient for making the most effective heat market.

This material is protected by copyright.

Any copying and distributing without active hyperlink is strictly prohibited!